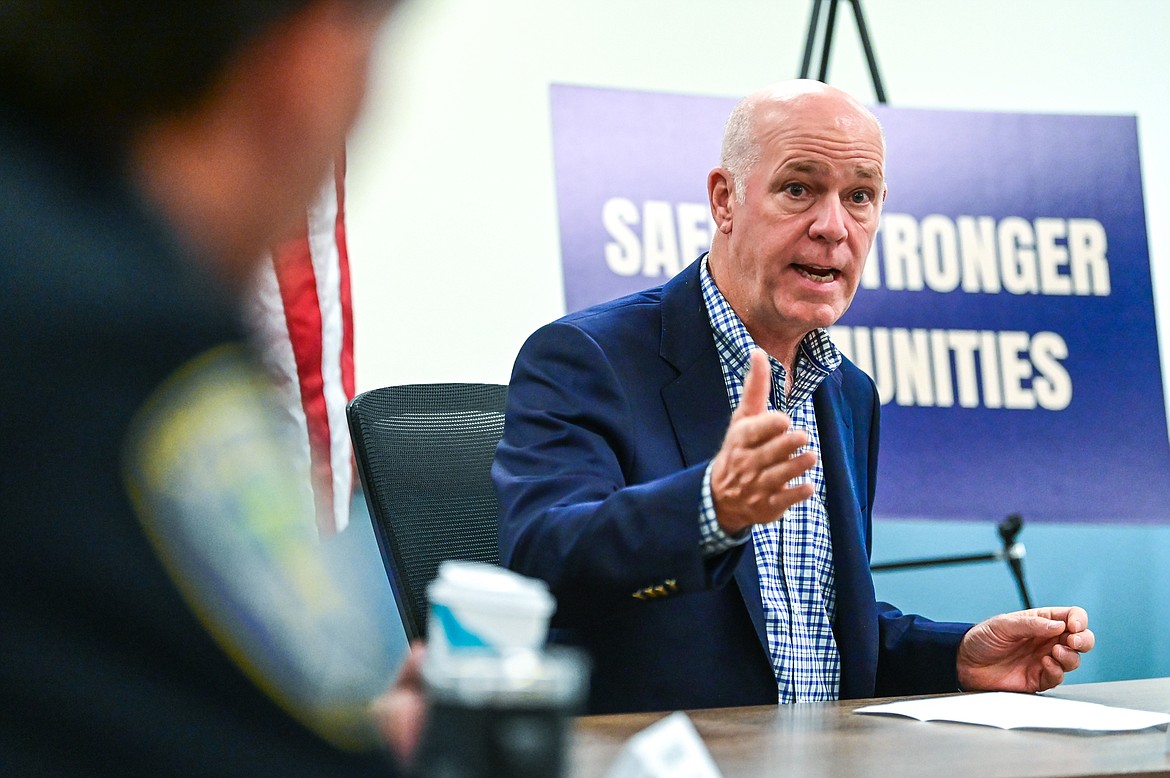

Gianforte names members to property tax task force

Gov. Greg Gianforte announced Thursday the membership of a task force charged with formulating recommendations for ways the state could reduce the burden property taxes put on Montana residents.

The group, which will be chaired by state Budget Director Ryan Osmundson, includes a bipartisan roster of state lawmakers as well as state officials, local government leaders, state and national tax policy experts, and members representing groups such as school boards, farmers, small businesses and realtors.

“We must protect Montana homeowners from rising property taxes, and I look forward to the work of the Property Tax Task Force to reform our property tax system and arrest the rate of growth of property taxes,” Gianforte said in a release.

The governor noted that the state has offered short-term property tax rebates in an effort to offset rising tax bills this year. He also called for “thoughtful, deliberate, long-term reforms to keep property taxes as low as possible, because the increasing strain of rising property taxes shouldn’t force Montana homeowners to consider selling the home they’ve owned and lived in for decades.”

An analysis by Montana Free Press found that property taxes rose on median by 21% on residential properties this year, driven partly by historic home value growth that has pulled tax burden onto residences from other types of properties. That analysis also found that tax bills decreased this year for many industrial properties owned by large businesses.

An executive order creating the group, which is modeled on Gianforte’s 2022 affordable housing task force, asks its members to formulate recommendations that could translate into bills during next year’s legislative session. It requires the group to provide the governor with a written report by Aug 15.

Gianforte’s order specifically asks the group to examine the following questions:

- How to slow the rate of property tax growth, including assessments and fees.

- How to make property tax bills more transparent and easier to understand, and how to improve customer service regarding payment schedules.

- How to increase transparency and engagement in public budgeting processes.

- How to increase public participation in mill levy ballot measures.

- How to ensure that the tax burdens on homeowners and long-term renters “reflect well on supporting homeownership and workforce housing.”

- How to ensure access to quality education. (Property taxes provide a significant share of funding for Montana schools.)

- How to ensure that lower-income Montana homeowners, including those who are on fixed incomes or who are disabled veterans, aren’t put at risk of losing their homes as a result of property taxes.

Neither the governor’s press release nor the executive order addresses whether the task force will discuss a potential statewide sales tax, a historically unpopular idea supported by some lawmakers and policy experts as a way to reduce homeowner tax burden by shifting some collections to a revenue source that would draw on tourists as well as residents.

Gianforte spokesperson Kaitlin Price didn’t rule out that possibility in response to a question Thursday, though she did say the governor remains opposed to the idea.

“The task force will go where it goes, but the governor has been clear: he does not support a statewide sales tax,” she wrote in an email.

The full membership is as follows:

- Ryan Osmundson, task force chair and Office of Budget and Program Planning director

- Sen. Greg Hertz, R-Polson, Senate Taxation Committee chair

- Sen. Tom McGillvray, R-Billings, Senate Finance & Claims Committee member

- Sen. Shane Morigeau, D-Missoula, Senate Finance & Claims Committee member

- Rep. David Bedey, R-Hamilton, House Appropriations Committee member

- Rep. Dave Fern, D-Whitefish, House Taxation Committee member

- Rep. Llew Jones, R-Conrad, House Appropriations Committee chair

- Brendan Beatty, Montana Department of Revenue director

- Manish Bhatt, senior policy analyst with the Center for State Tax Policy at the Tax Foundation

- Kendall Cotton, president and CEO of the Frontier Institute

- Errol Galt, Meagher County commissioner

- Pam Holmquist, Flathead County commissioner

- Jeremy Horpedahl, Ph.D., associate professor of economics and director of Arkansas Center for Research in Economics at the University of Central Arkansas

- Dwaine Iverson, board member of the Montana Taxpayers Association and CPA

- Cyndi Johnson, president of the Montana Farm Bureau Federation

- Sean Logan, Helena city commissioner

- Lance Melton, executive director of the Montana School Boards Association

- Gordon Oelkers, Roosevelt County commissioner

- Todd O’Hair, president and CEO of the Montana Chamber of Commerce

- Justin Ross, Ph.D., professor of economics and public finance, Paul H. O’Neill School of Public and Environmental Affairs at Indiana University

- Derek “DJ” Smith, president of the Montana Association of Realtors

- Sandra Vasecka, Missoula City Council member

- Ronda Wiggers, Montana State Director of the National Federation of Independent Business